Your Personal Guide to Win with Money

Financial coaching is all about you. It’s about understanding your current situation and developing a custom plan to help you win with money.

Whether you’re burdened by debt, need help with big money goals,

or just want to get on the same page with your spouse,

a trained coach will walk with you as you make real progress with your finances.

One-on-one Financial Coaching can help you

Get out of debt with a personalized plan

Set up a monthly budget and stick to it

Actually pay off students loans

Prepare to buy a home

Improve your financial long-term plans

“One day” or day one. You decide.

Fill out the form below, and Umbrella Preferred Coaches will contact you to set up your complimentary consultation.

How to get started with your Personal Coach

Equality starts with equal access to wealth

Book a Consultation

This is a hassle-free, no-obligation call to get to know each other a bit. It gives me a chance to hear more about your situation and specific needs, and gives you a chance to see if we’ll be a good fit.

Get practical guidance - no shame or judgement

Once we outline your areas of biggest need, we’ll work together to create a plan to help you reach

your goals.

A plan to reach your biggest dreams

True change comes when behavior is adjusted, not simply understanding concepts. I’m here to coach you along the way to help you reach your goals.

5 Steps to the path of

financial empowerment

5 Steps to the the path to financial empowerment

Earn

- Paychecks

- Recurring Revenue

- Freelance Gigs

- Career Changes

Spend

- Track Spending

- Categorize Spending

- Budgeting

- Automate Savings

Borrow

- Credit Score

- Smart Debt

- Student & Auto Loans

- Mortgages

Save & Invest

- Fund Retirement

- College Savings

- Advanced Estate

- Planning

- Health Savings Account

Protect

- Emergency Fund

- Insurance

- Identity Theft

- Simple Estate Planning

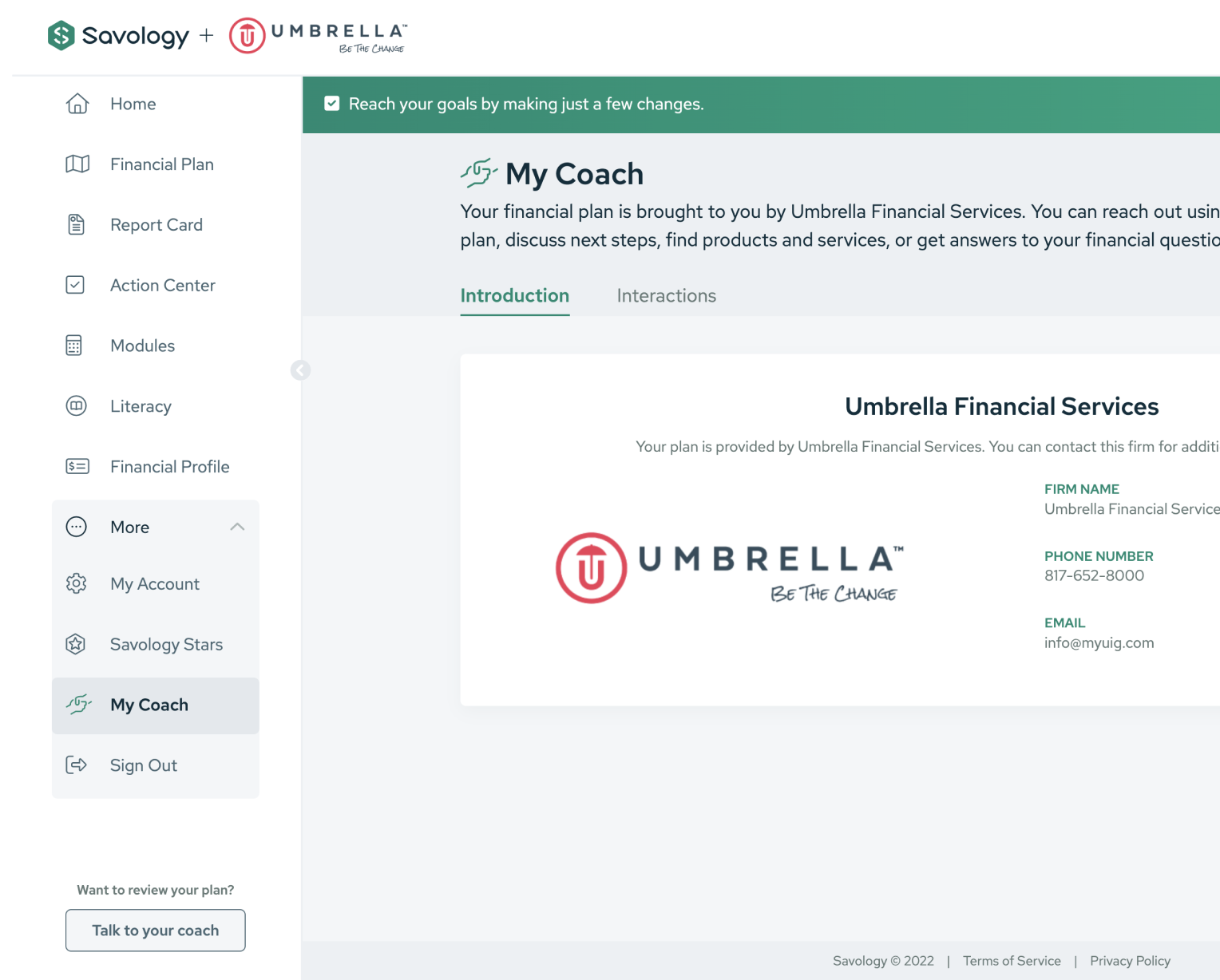

Get immediate, on-demand personalized financial coaching

Many people are stressed trying to provide for their kids and still reach their long-term financial goals. I help them build a simple plan to find that balance.

Umbrella Certified Financial Coach

Book a Consultation

SCHEDULING

Set a time with me for your complimentary consultation by selecting a date from the calendar below.

"*" indicates required fields

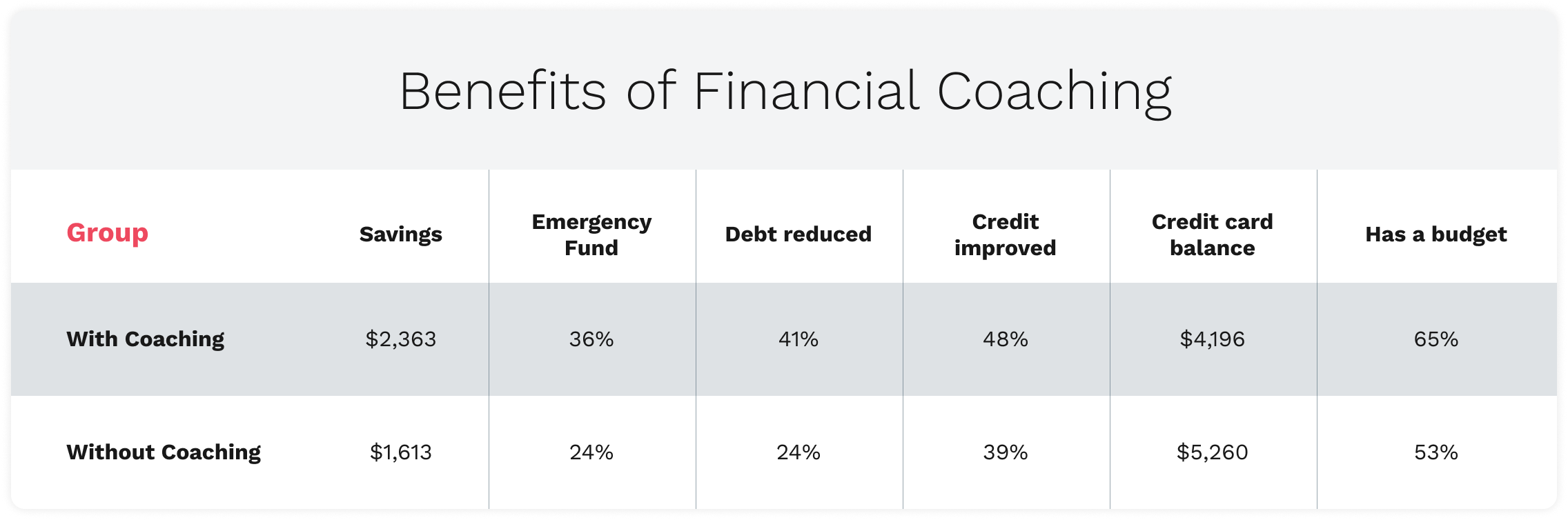

Benefits of financial coaching.

What Umbrella Coaching Clients are saying.

Debbie and Anthony Guarino

Eric Rivers

Financial coaching helped tailor-fit what we learned from Financial Peace University to our own specific situation. After our sessions were complete, we felt more confident about the path ahead.

Margie Scudder

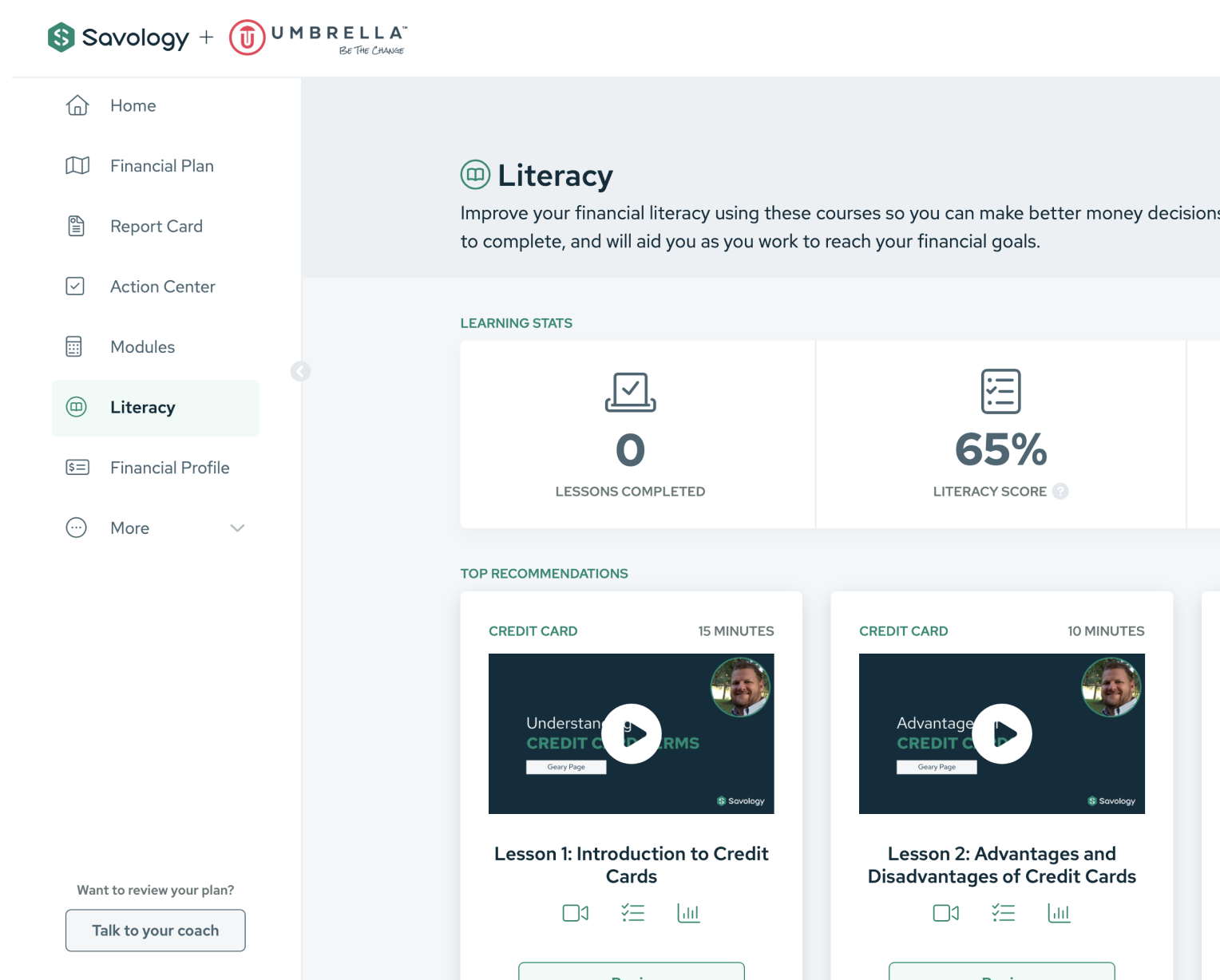

Get immediate access to your financial coaching dashboard

One monthly membership designed to help you manage your money.

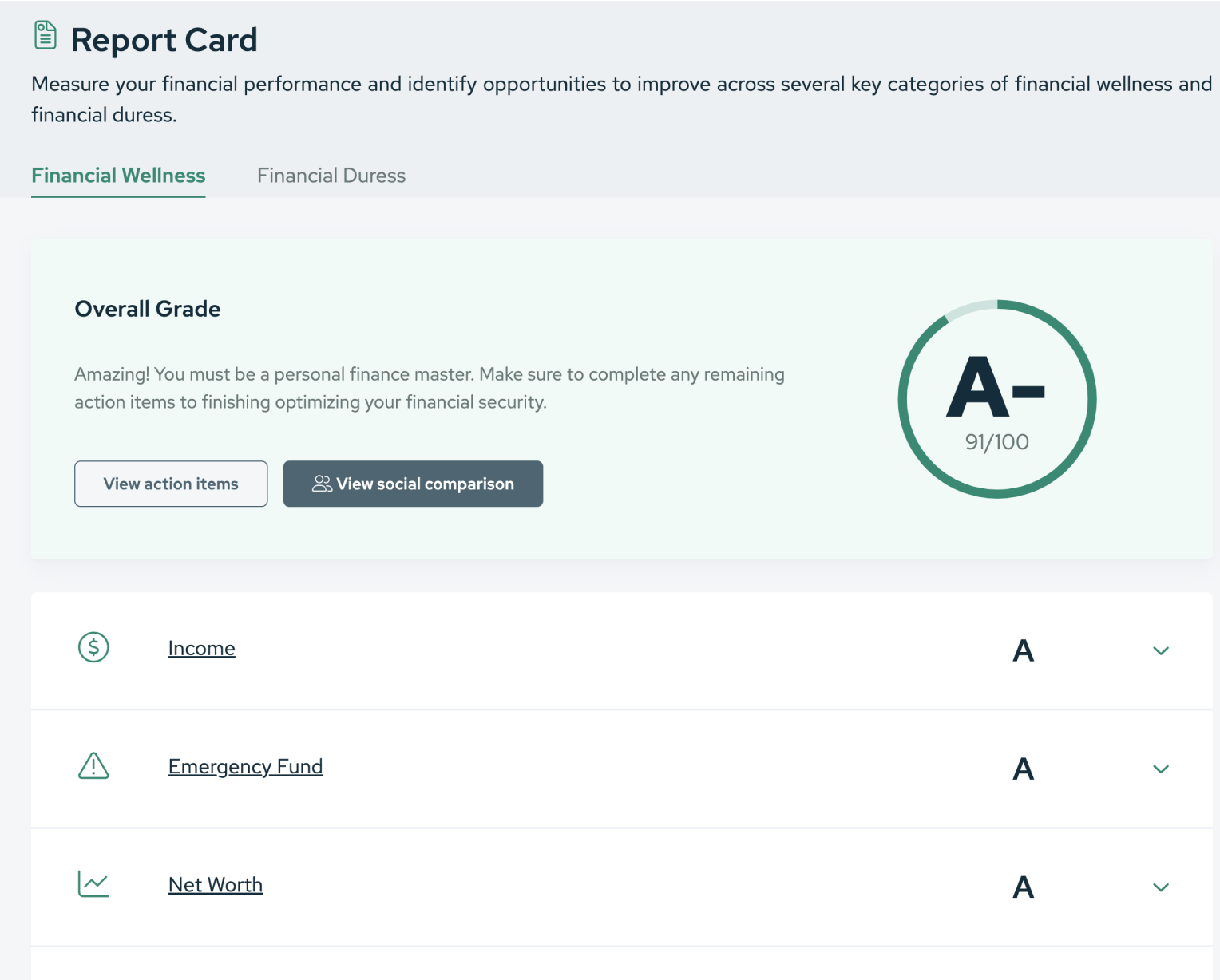

Report card

Get started by answering a few questions about your

personal finances in just a few minutes.

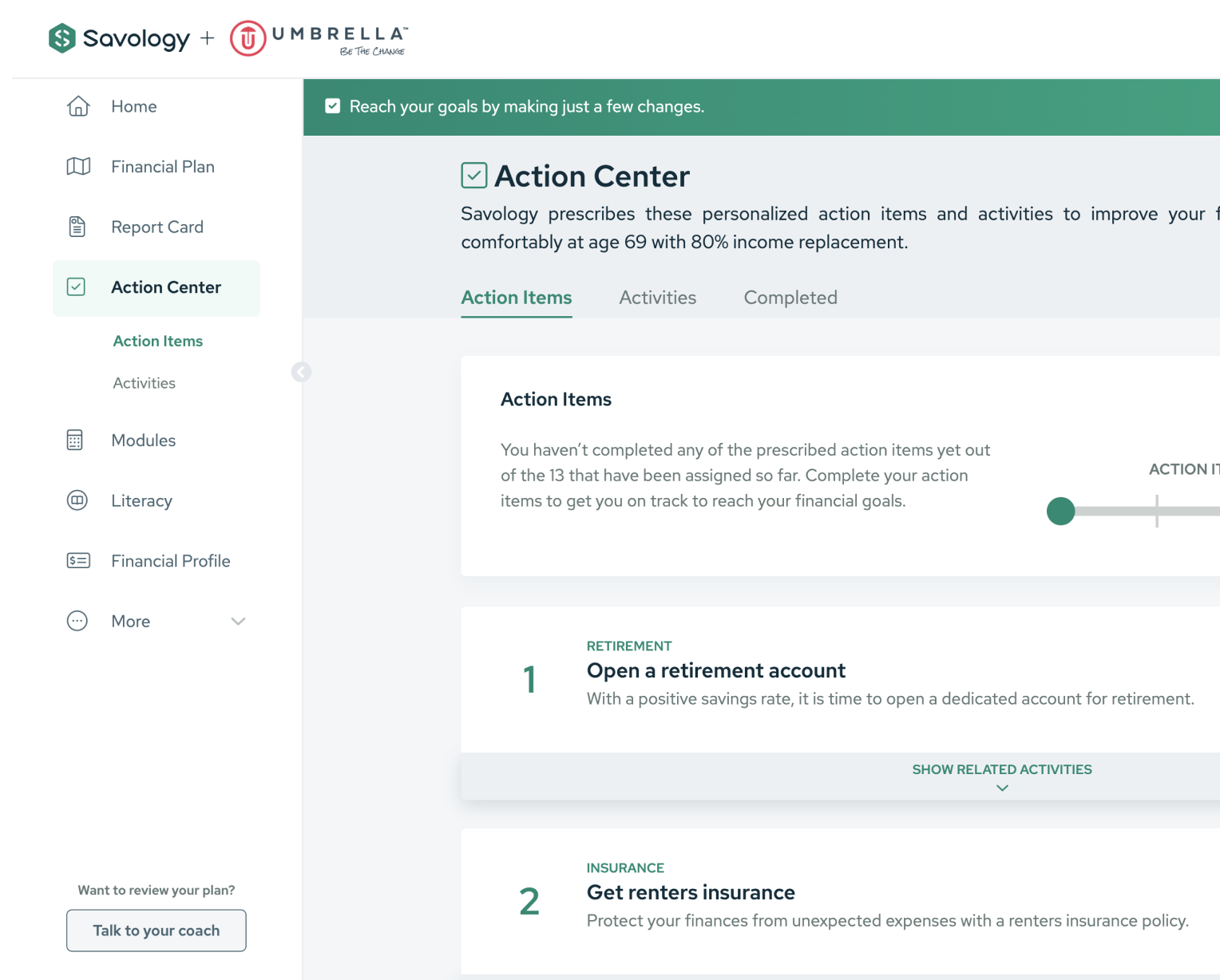

Planning and action items

Take action TODAY to improve your financial health

1:1 Coaching

talk with real-life financial coaches.

Resources

Bit-sized financial literacy lessons so you can get better

with money, one step at a time

With Umbrella Financial Coaching, a healthier relationship with money is possible

It’s not about how much you make, it’s about how much you keep!

- Holistic financial plan

- Financial counseling

- Financial report card

- Roadside assistance

- Personalized action items

- Identity theft protection

- Estate plan and insurance review

- Travel security

- Financial literacy and education

- Cashback rewards

- Retirement projections & planning

- Legal support

- Core planning modules & calculators

- Living will & trust

- AI-backed budgeting

- Tax support

Learn more here.

Personal Coaching

$89.95/mo

Learn more here.

Frequently asked questions (FAQs)

How long does it take to build a plan?

Then, it’s up to you to explore your financial plan, report card, and action items in more detail. After you get the results about your current financial well-being, we recommend spending more time diving deep into your whole plan to increase your understanding.

Is Umbrella Financial secure?

What do I do with my financial plan?

How often should I use Umbrella?

At a minimum, we recommend revisiting your plan at the following times: First, log in every time you complete an Action Item to mark it off and read about the next item on your list. Second, come back to your account to complete additional planning modules as they are made available every couple months. And third, come back to update your financial information anytime you have a significant change, but no less frequently than twice a year. For the most part, you will receive email reminders to keep you on track.